For Over 30 Years GenerationTax Has Been the Definitive Source for MBA Tax Related Issues

Lewis Weinstein speaking at HBS |

HAVE A QUESTION

Call or email Lewis Weinstein TOP MBA TAX STRATEGIES

Consider a Roth IRA Conversion During Your Low Income Years Consider Withdrawing Funds From Your IRA–Penalty Free Consider Recognizing Long- Term Capital Gains in Low Income Years |

Your MBA Could Significantly

Reduce Your 2023 Taxes!

by Lewis A. Weinstein

Founder of GenerationTax

Many state tax jurisdictions do not conform to the federal tax laws regarding deducting MBA expenses. As a result, you may be eligible to deduct your MBA expenses on your 2023 state tax return and be entitled to significant tax savings. For example, New York and California allow you to deduct qualified MBA expenses if you meet the criteria below. The tax savings can be substantial. For instance, if you worked in New York City and paid $50,000 in qualified tuition in 2023 you could save over $4,000 in taxes.

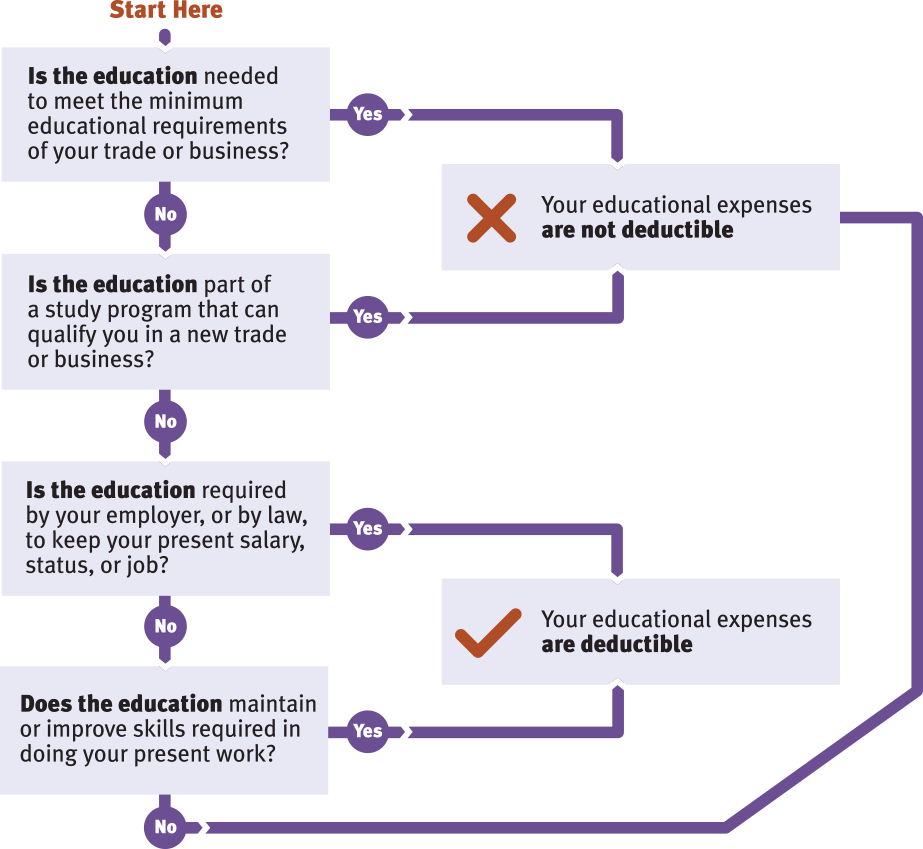

Deductible Requirements:

First, the education must be related to a trade or business which you are “carrying on.” Secondly, the education must not be a minimum educational requirement for qualification in your trade or business, nor can it qualify you for a new trade or business. Finally, the education must maintain or improve skills needed in your profession.

The Gray Areas:

Concern 1: Am I “carrying on” (required answer: yes)? Attending graduate school full time generally precludes being actively involved in a trade or business. However, this is not, in and of itself, fatal. Assuming that you were engaged in a trade or business before coming to school (nowhere explicitly defined, but significant work experience like that of most MBAs would generally qualify), a temporary leave of absence or other suspension of involvement in a trade or business is allowable. “Temporary” is defined as less than one year, but the courts have allowed for substantially longer absences (up to several years.)

Concern 2: Is the education needed to meet the minimum educational requirement of your trade or business (required answer: no)? The minimum education necessary in your profession must be determined from a consideration of such factors as the requirements of your employer, the applicable law and regulations, and the standards of your profession. This disallowance criteria is generally not applicable to many MBAs pursuing graduate study in business, since their undergraduate degree has typically satisfied the minimum entry requirements in their profession and of their employers.

Concern 3: Is the education part of a study program that can qualify you in a new trade or business (required answer: no)? The question of whether or not your education expenses can qualify you in a new trade of business requires a commonsense approach. You must analyze your work experience and the skills, tasks and activities you were qualified to perform before the education in comparison to those you were qualified to perform afterward. You will generally meet this criteria if you had substantial work experience and your MBA courses were directly related to, and built upon your skills required in your profession both before and after business school. It is acceptable to change industries and employers when you graduate. However, you must be able to demonstrate that your MBA maintained and improved your skills required in your position prior to business school and that you continued to use those same skills required in the position you took when you matriculated. Furthermore, many MBA classes are general in nature and are applicable to a wide range of business tasks and problems. Even more specialized classes i.e. a corporate tax class, should be valuable to most MBAs, but without qualifying them for a new trade or business.

Concern 4: Does an MBA maintain or improve skills required doing your present work (required answer: yes)? The case law on this issue varies, but it is clear that the more business-like your old career and duties, the more likely you will be considered to be maintaining or improving skills.

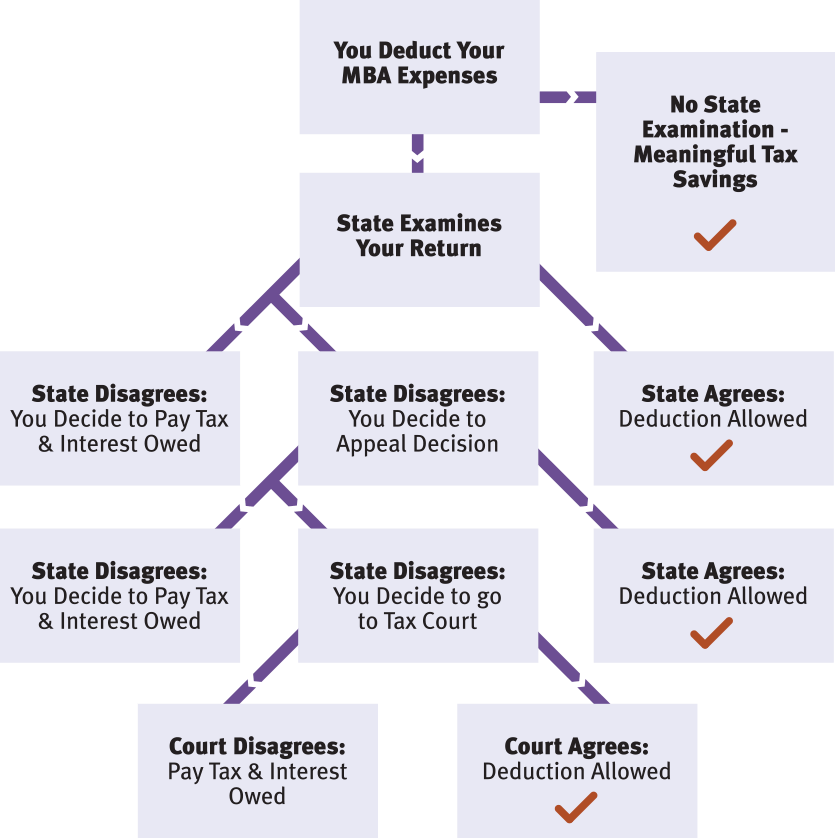

The proper application of state income rules for deducting qualified MBA expenses is frequently uncertain. You must analyze your specific circumstances in evaluating whether or not you qualify to take a tax deduction for graduate school. If you have questions with respect to your personal situation, I would strongly recommend that you utilize the services of a qualified tax professional.

Rules for Determining Eligibility

Deductible Educational Expenses

Qualified education expenses paid in the tax year are deductible to the extent they exceed 2% of your adjusted gross income and you are itemizing your deductions. You can take out loans to pay for tuition expenses and deduct it in the year the funds are credited to the University (not when the loans are later repaid to the lender). Deductible education expenses include:

- Tuition & Fees

- Case Materials and Books

- Computers & Peripherals (if required by curriculum)

- Miscellaneous Supplies

The Upside & Downside to Deducting MBA Expenses

We stand by every return

with FREE audit and examination assistance.

|

Unmatched Experience & Expertise! Free Audit Assistance Proactive Tax Planning Free Phone Consultation Unconditional Money Back Guarantee Email

or Call us Today

|